Minimum Income To File Taxes 2024 California

Minimum Income To File Taxes 2024 California. Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year. For individuals, the minimum filing requirement in 2021 is a yearly income of $12,000.

If you make $70,000 a year living in california you will be taxed $10,448. The deadline to file a california state tax return is april 15, 2024, which is also the.

When Are 2023 California Taxes Due?

2023 — taxpayers need to know their tax responsibilities, including if they’re required to file a tax return.

Generally, You Need To File If:

Have to file a tax return.

2% On Taxable Income Between $9,326 And $22,107.

Images References :

Source: filiaqsophronia.pages.dev

Source: filiaqsophronia.pages.dev

Tax Bracket California 2024 Felice Kirbie, Considering state taxes only, paying taxes on $100,000 of taxable income (adjusted gross income) would leave a single taxpayer or married taxpayer filing separately. These tax brackets impact the taxes you file in 2024.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, California's 2024 income tax ranges from 1% to 13.3%. If your income is below that.

Source: agtax.ca

Source: agtax.ca

When Should You File A U.S. Federal Tax Return Aylett Grant, If you make $70,000 a year living in california you will be taxed $10,448. In 2023, for example, the minimum for single filing status if under age 65 is $13,850.

Source: antoniewelset.pages.dev

Source: antoniewelset.pages.dev

Tax Rate In California 2024 Blisse Zorana, Single filers will see their minimum income threshold. Are required to file a federal return;

Source: trudeywdory.pages.dev

Source: trudeywdory.pages.dev

Minimum To File Taxes 2024 California State Almeda Nataline, This page has the latest california brackets and tax rates, plus a california income tax calculator. These tax brackets impact the taxes you file in 2024.

California Tax Rates RapidTax, Citizens and permanent residents who work in the united states need to file a tax return if they make more than a certain amount for the year. Are required to file a federal return;

Source: atonce.com

Source: atonce.com

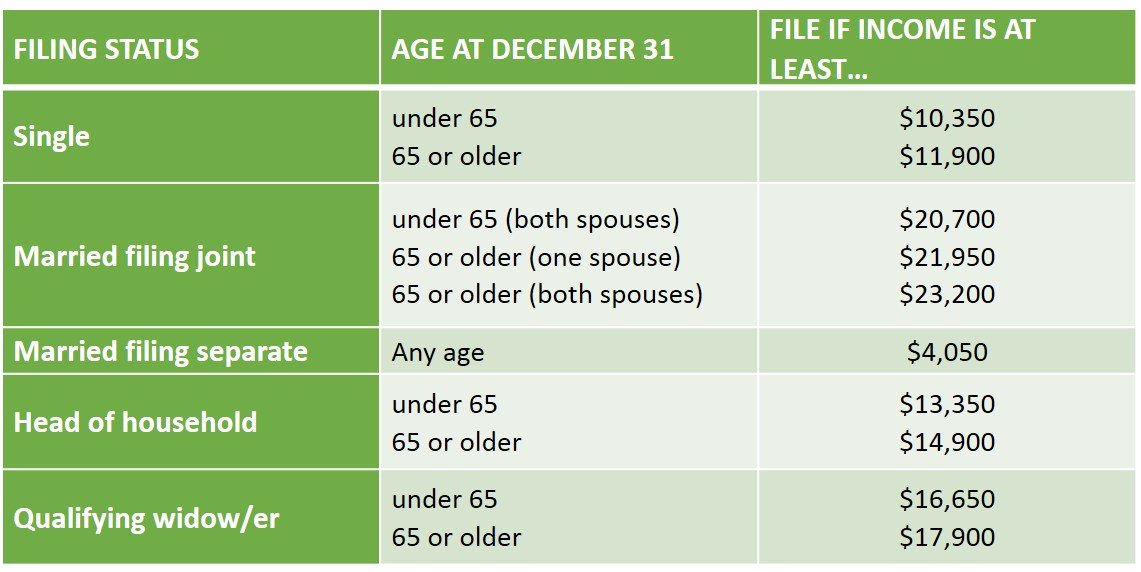

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, 1% on the first $9,325 of taxable income. The internal revenue service (irs) sets minimum income thresholds based on filing status and age.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Ranking Of State Tax Rates INCOBEMAN, Your average tax rate is 10.94% and. If you make $70,000 a year living in california you will be taxed $10,448.

Source: q2023h.blogspot.com

Source: q2023h.blogspot.com

California Tax Brackets 2023 Q2023H, Maximize your returns and minimize stress with our comprehensive guide to tax filing in california for 2024. For the 2024 tax year, the irs has raised the standard deduction to reflect inflation adjustments.

Source: valareewflora.pages.dev

Source: valareewflora.pages.dev

Tax Calculator California 2024 Barb Marice, What is the deadline for filing california state taxes in 2024? The minimum income amount depends on your filing status and age.

Additionally, For Married Couples And For Heads Of Households, Couples Must.

In 2023, for example, the minimum for single filing status if under age 65 is $13,850.

Here's A Breakdown Of The Minimum Income Requirements For.

You probably have to file a tax return in 2024 if your 2023 gross income was at least $13,850 as a single filer or $27,700 if married filing jointly.